#Emerging Markets Index

Explore tagged Tumblr posts

Link

India is seeing a surge in domestic investments. At the same time, it’s attracting more foreign investment and portfolio flows. This performance surpasses Morgan Stanley Capital International (MSCI) Emerging Markets by 45.5% from early 2021 to October 2022, and this trend is likely to persist.

#consumer price index#European Union#fdi inflows#Gulf Cooperation Council#Indian economy#Indian Market#Morgan Stanley Capital International#Market analysis#MorganStanley#Emerging Markets Index#SEBI#FDI#cpi#news#blogging#bloggers#latest updates#latest news#news today

0 notes

Text

Video: My Brand New Shiny RRSP Portfolio

I take you on my #journey to getting a brand new shiny #RRSP #portfolio. I choose the #wealthsimple #brokerage, sell my #mutualfunds, and share what #assets I am buying, specifically #index #ETFs covering the #TSX, #SP500, #developed #markets and #emerging #markets. I also get #smallcap #stock #ETF, a #technology ETF and a #bond fund as a #piggybank. The #CanadianMoneyTalk channel concentrates…

View On WordPress

#assets#bond#brokerage#developed#emerging#ETF#ETFs#index#journey#markets#mutualfunds#piggybank#portfolio#rrsp#smallcap#SP500#stock#Technology#TSX#wealthsimple

0 notes

Text

Expert Insights into Housing Market Analysis

Unlock the latest trends and insights with Housing Market Analysis at PKHalder.com. Discover comprehensive data and expert evaluations to help you navigate the complexities of the housing sector. Whether you’re an investor, homeowner, or industry professional, our platform delivers valuable resources on housing price trends, market stability, and emerging opportunities.

Explore how economic factors, government policies, and global events shape the real estate market. Stay informed with in-depth reports and strategies tailored for informed decision-making. From urban growth projections to affordability indexes, our content ensures you’re always ahead in understanding the dynamics of the housing market.

Gain a competitive edge with actionable insights designed to empower you in achieving your real estate goals. Visit PKHalder.com for reliable Housing Market Analysis today!

#Housing Market Analysis#Real Estate Market Insights#Housing Price Trends#Market Stability Reports#Housing Sector Evaluation#Real Estate Investment Strategies#Housing Affordability Index#Urban Growth Projections#Emerging Housing Market Opportunities

0 notes

Text

How the Rise in Dollar Index Can Affect the Stock Markets in the U.S. and Worldwide

The Dollar Index (DXY) is a key measure of the value of the U.S. dollar relative to a basket of six major foreign currencies: the Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Canadian Dollar (CAD), Swedish Krona (SEK), and Swiss Franc (CHF). Investors and policymakers closely monitor the Dollar Index as an indicator of the strength or weakness of the U.S. dollar in the global economy. A…

#Commodity Prices#Corporate Earnings#Currency Fluctuations#Currency Strength#Dollar Appreciation#Dollar Index#economic impact#Emerging Markets#Federal Reserve#Financial Analysis#Financial Markets#Global Economics#Global Stock Markets#Global Trade#Interest Rates#International Stocks#Investment Strategy#Risk Management#Stock market volatility#stock markets#stock trading#U.S. Dollar#U.S. Stock Market

0 notes

Text

"India's MSCI Weight Hits New High: Expect More Equity Inflows"

India’s significance in the MSCI Global Standard index, tracking emerging market stocks, has reached a new pinnacle, signaling potential for increased inflows into its equity markets.

In the latest update, India’s weight in the MSCI index has surged to 19%, inching closer to China’s 25%. This rise is expected to attract approximately $2 billion in inflows by the end of May.

With 13 Indian companies set to join the Global Standard Index, India’s stock count in the MSCI index is at an all-time high of 149, showcasing the country’s growing prominence in emerging markets.

Analysts predict that India’s weightage in the MSCI index could surpass 20% by the second half of 2024, driven by consistent flows from domestic and foreign institutional investors.

This surge in India’s MSCI weight is attributed to the robust performance of its equities, particularly in the mid-cap segment, compared to other emerging markets like China.

The addition of prominent Indian companies such as JSW Energy, Canara Bank, and Mankind Pharma to the Global Standard Index further solidifies India’s position in the global equity landscape.

As India continues to strengthen its foothold in emerging markets, investors can anticipate further momentum in equity inflows, bolstering the country’s economic prospects.

0 notes

Text

Diversification: Spreading Your Investment Risk for Long-Term Growth

Introduction: Welcome to another insightful blog post on personal finance and investing. Today, we’ll be delving into the concept of diversification and its vital role in spreading investment risk for long-term growth. Whether you’re a seasoned investor or just starting out, understanding and implementing diversification strategies can significantly enhance your investment portfolio’s stability…

View On WordPress

#Asset Allocation#asset classes#Bonds#Diversification#diversification strategies#emerging markets#ETFs#Financial Goals#financial journey#geographic diversification#growth opportunities#improved returns#Index funds#industry-specific risks#international diversification#Investing#investment portfolio diversification#investment risk#Investment Strategy#Investment Vehicles#long term growth#Market Volatility#Mutual Funds#Personal Finance#portfolio rebalancing#risk reduction#risk tolerance#sector diversification#stability#Stocks

1 note

·

View note

Text

Generally speaking, here are the order of financial priorities:

Build an emergency savings of at least 3 months worth of living expenses

Pay down all high-interest debts, such as credit card debts

Build an emergency savings of 6 months - year worth of expenses.

Place some of your savings in a high-yield savings account (or money market fund) that you can still access easily without penalty if you need that money.

Start considering investing in something that yields a higher rate of return, but requires that you let money just *sit* in that investment for months or years at a time (CDs/bonds/index funds/a 401k [which is really just a type of index fund usually]).

Learn how to let your investments just sit without constantly looking at them or worrying about them! This is a skill that requires time, practice, and sometimes research to develop.

As your circumstances change and your familiarity and comfort with investing grows, tweak your exact investment strategy as needed. (For example, shift some money from index funds to bonds as you get older, or move CD investments to stocks as interest rates go down).

441 notes

·

View notes

Text

UK publishers suing Google for $17.4b over rigged ad markets

THIS WEEKEND (June 7–9), I'm in AMHERST, NEW YORK to keynote the 25th Annual Media Ecology Association Convention and accept the Neil Postman Award for Career Achievement in Public Intellectual Activity.

Look, no one wants to kick Big Tech to the curb more than I do, but, also: it's good that Google indexes the news so people can find it, and it's good that Facebook provides forums where people can talk about the news.

It's not news if you can't find it. It's not news if you can't talk about it. We don't call information you can't find or discuss "news" – we call it "secrets."

And yet, the most popular – and widely deployed – anti-Big Tech tactic promulgated by the news industry and supported by many of my fellow trustbusters is premised on making Big Tech pay to index the news and/or provide a forum to discuss news articles. These "news bargaining codes" (or, less charitably, "link taxes") have been mooted or introduced in the EU, France, Spain, Australia, and Canada. There are proposals to introduce these in the US (through the JCPA) and in California (the CJPA).

These US bills are probably dead on arrival, for reasons that can be easily understood by the Canadian experience with them. After Canada introduced Bill C-18 – its own news bargaining code – Meta did exactly what it had done in many other places where this had been tried: blocked all news from Facebook, Instagram, Threads, and other Meta properties.

This has been a disaster for the news industry and a disaster for Canadians' ability to discuss the news. Oh, it makes Meta look like assholes, too, but Meta is the poster child for "too big to care" and is palpably indifferent to the PR costs of this boycott.

Frustrated lawmakers are now trying to figure out what to do next. The most common proposal is to order Meta to carry the news. Canadians should be worried about this, because the next government will almost certainly be helmed by the far-right conspiratorialist culture warrior Pierre Poilievre, who will doubtless use this power to order Facebook to platform "news sites" to give prominence to Canada's rotten bushel of crypto-fascist (and openly fascist) "news" sites.

Americans should worry about this too. A Donald Trump 2028 presidency combined with a must-carry rule for news would see Trump's cabinet appointees deciding what is (and is not) news, and ordering large social media platforms to cram the Daily Caller (or, you know, the Daily Stormer) into our eyeballs.

But there's another, more fundamental reason that must-carry is incompatible with the American system: the First Amendment. The government simply can't issue a blanket legal order to platforms requiring them to carry certain speech. They can strongly encourage it. A court can order limited compelled speech (say, a retraction following a finding of libel). Under emergency conditions, the government might be able to compel the transmission of urgent messages. But there's just no way the First Amendment can be squared with a blanket, ongoing order issued by the government to communications platforms requiring them to reproduce, and make available, everything published by some collection of their favorite news outlets.

This might also be illegal in Canada, but it's harder to be definitive. The Canadian Charter of Rights and Freedoms was enshrined in 1982, and Canada's Supreme Court is still figuring out what it means. Section Two of the Charter enshrines a free expression right, but it's worded in less absolute terms than the First Amendment, and that's deliberate. During the debate over the wording of the Charter, Canadian scholars and policymakers specifically invoked problems with First Amendment absolutism and tried to chart a middle course between strong protections for free expression and problems with the First Amendment's brook-no-exceptions language.

So maybe Canada's Supreme Court would find a must-carry order to Meta to be a violation of the Charter, but it's hard to say for sure. The Charter is both young and ambiguous, so it's harder to be definitive about what it would say about this hypothetical. But when it comes to the US and the First Amendment, that's categorically untrue. The US Constitution is centuries older than the Canadian Charter, and the First Amendment is extremely definitive, and there are reams of precedent interpreting it. The JPCA and CJPA are totally incompatible with the US Constitution. Passing them isn't as silly as passing a law declaring that Pi equals three or that water isn't wet, but it's in the neighborhood.

But all that isn't to say that the news industry shouldn't be attacking Big Tech. Far from it. Big Tech compulsively steals from the news!

But what Big Tech steals from the news isn't content.

It's money.

Big Tech steals money from the news. Take social media: when a news outlet invests in building a subscriber base on a social media platform, they're giving that platform a stick to beat them with. The more subscribers you have on social media, the more you'll be willing to pay to reach those subscribers, and the more incentive there is for the platform to suppress the reach of your articles unless you pay to "boost" your content.

This is plainly fraudulent. When I sign up to follow a news outlet on a social media site, I'm telling the platform to show me the things the news outlet publishes. When the platform uses that subscription as the basis for a blackmail plot, holding my desire to read the news to ransom, they are breaking their implied promise to me to show me the things I asked to see:

https://www.eff.org/deeplinks/2023/06/save-news-we-need-end-end-web

This is stealing money from the news. It's the definition of an "unfair method of competition." Article 5 of the Federal Trade Commission Act gives the FTC the power to step in and ban this practice, and they should:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

Big Tech also steals money from the news via the App Tax: the 30% rake that the mobile OS duopoly (Apple/Google) requires for every in-app purchase (Apple/Google also have policies that punish app vendors who take you to the web to make payments without paying the App Tax). 30% out of every subscriber dollar sent via an app is highway robbery! By contrast, the hyperconcentrated, price-gouging payment processing cartel charges 2-5% – about a tenth of the Big Tech tax. This is Big Tech stealing money from the news:

https://www.eff.org/deeplinks/2023/06/save-news-we-must-open-app-stores

Finally, Big Tech steals money by monopolizing the ad market. The Google-Meta ad duopoly takes 51% out of every ad-dollar spent. The historic share going to advertising "intermediaries" is 10-15%. In other words, Google/Meta cornered the market on ads and then tripled the bite they were taking out of publishers' advertising revenue. They even have an illegal, collusive arrangement to rig this market, codenamed "Jedi Blue":

https://en.wikipedia.org/wiki/Jedi_Blue

There's two ways to unrig the ad market, and we should do both of them.

First, we should trustbust both Google and Meta and force them to sell off parts of their advertising businesses. Currently, both Google and Meta operate a "full stack" of ad services. They have an arm that represents advertisers buying space for ads. Another arm represents publishers selling space to advertisers. A third arm operates the marketplace where these sales take place. All three arms collect fees. On top of that: Google/Meta are both publishers and advertisers, competing with their own customers!

This is as if you were in court for a divorce and you discovered that the same lawyer representing your soon-to-be ex was also representing you…while serving as the judge…and trying to match with you both on Tinder. It shouldn't surprise you if at the end of that divorce, the court ruled that the family home should go to the lawyer.

So yeah, we should break up ad-tech:

https://www.eff.org/deeplinks/2023/05/save-news-we-must-shatter-ad-tech

Also: we should ban surveillance advertising. Surveillance advertising gives ad-tech companies a permanent advantage over publishers. Ad-tech will always know more about readers' behavior than publishers do, because Big Tech engages in continuous, highly invasive surveillance of every internet user in the world. Surveillance ads perform a little better than "content-based ads" (ads sold based on the content of a web-page, not the behavior of the person looking at the page), but publishers will always know more about their content than ad-tech does. That means that even if content-based ads command a slightly lower price than surveillance ads, a much larger share of that payment will go to publishers:

https://www.eff.org/deeplinks/2023/05/save-news-we-must-ban-surveillance-advertising

Banning surveillance advertising isn't just good business, it's good politics. The potential coalition for banning surveillance ads is everyone who is harmed by commercial surveillance. That's a coalition that's orders of magnitude larger than the pool of people who merely care about fairness in the ad/news industries. It's everyone who's worried about their grandparents being brainwashed on Facebook, or their teens becoming anorexic because of Instagram. It includes people angry about deepfake porn, and people angry about Black Lives Matter protesters' identities being handed to the cops by Google (see also: Jan 6 insurrectionists).

It also includes everyone who discovers that they're paying higher prices because a vendor is using surveillance data to determine how much they'll pay – like when McDonald's raises the price of your "meal deal" on your payday, based on the assumption that you will spend more when your bank account is at its highest monthly level:

https://pluralistic.net/2024/06/05/your-price-named/#privacy-first-again

Attacking Big Tech for stealing money is much smarter than pretending that the problem is Big Tech stealing content. We want Big Tech to make the news easy to find and discuss. We just want them to stop pocketing 30 cents out of every subscriber dollar and 51 cents out of ever ad dollar, and ransoming subscribers' social media subscriptions to extort publishers.

And there's amazing news on this front: a consortium of UK web-publishers called Ad Tech Collective Action has just triumphed in a high-stakes proceeding, and can now go ahead with a suit against Google, seeking damages of GBP13.6b ($17.4b) for the rigged ad-tech market:

https://www.reuters.com/technology/17-bln-uk-adtech-lawsuit-against-google-can-go-ahead-tribunal-rules-2024-06-05/

The ruling, from the Competition Appeal Tribunal, paves the way for a frontal assault on the thing Big Tech actually steals from publishers: money, not content.

This is exactly what publishing should be doing. Targeting the method by which tech steals from the news is a benefit to all kinds of news organizations, including the independent, journalist-owned publishers that are doing the best news work today. These independents do not have the same interests as corporate news, which is dominated by hedge funds and private equity raiders, who have spent decades buying up and hollowing out news outlets, and blaming the resulting decline in readership and profits on Craiglist.

You can read more about Big Finance's raid on the news in Margot Susca's Hedged: How Private Investment Funds Helped Destroy American Newspapers and Undermine Democracy:

https://www.press.uillinois.edu/books/?id=p087561

You can also watch/listen to Adam Conover's excellent interview with Susca:

https://www.youtube.com/watch?v=N21YfWy0-bA

Frankly, the looters and billionaires who bought and gutted our great papers are no more interested in the health of the news industry or democracy than Big Tech is. We should care about the news and the workers who produce the news, not the profits of the hedge-funds that own the news. An assault on Big Tech's monetary theft levels the playing field, making it easier for news workers and indies to compete directly with financialized news outlets and billionaire playthings, by letting indies keep more of every ad-dollar and more of every subscriber-dollar – and to reach their subscribers without paying ransom to social media.

Ending monetary theft – rather than licensing news search and discussion – is something that workers are far more interested in than their bosses. Any time you see workers and their bosses on the same side as a fight against Big Tech, you should look more closely. Bosses are not on their workers' side. If bosses get more money out of Big Tech, they will not share those gains with workers unless someone forces them to.

That's where antitrust comes in. Antitrust is designed to strike at power, and enforcers have broad authority to blunt the power of corporate juggernauts. Remember Article 5 of the FTC Act, the one that lets the FTC block "unfair methods of competition?" FTC Chair Lina Khan has proposed using it to regulate training AI, specifically to craft rules that address the labor and privacy issues with AI:

https://www.youtube.com/watch?v=3mh8Z5pcJpg

This is an approach that can put creative workers where they belong, in a coalition with other workers, rather than with their bosses. The copyright approach to curbing AI training is beloved of the same media companies that are eagerly screwing their workers. If we manage to make copyright – a transferrable right that a worker can be forced to turn over their employer – into the system that regulates AI training, it won't stop training. It'll just trigger every entertainment company changing their boilerplate contract so that creative workers have to sign over their AI rights or be shown the door:

https://pluralistic.net/2024/05/13/spooky-action-at-a-close-up/#invisible-hand

Then those same entertainment and news companies will train AI models and try to fire most of their workers and slash the pay of the remainder using those models' output. Using copyright to regulate AI training makes changes to who gets to benefit from workers' misery, shifting some of our stolen wages from AI companies to entertainment companies. But it won't stop them from ruining our lives.

By contrast, focusing on actual labor rights – say, through an FTCA 5 rulemaking – has the potential to protect those rights from all parties, and puts us on the same side as call-center workers, train drivers, radiologists and anyone else whose wages are being targeted by AI companies and their customers.

Policy fights are a recurring monkey's paw nightmare in which we try to do something to fight corruption and bullying, only to be outmaneuvered by corrupt bullies. Making good policy is no guarantee of a good outcome, but it sure helps – and good policy starts with targeting the thing you want to fix. If we're worried that news is being financially starved by Big Tech, then we should go after the money, not the links.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/06/stealing-money-not-content/#content-free

#pluralistic#competition#advertising#surveillance advertising#saving the news from big tech#link taxes#trustbusting#competition and markets authority#uk#ukpoli#Ad Tech Collective Action#digital markets unit#Competition Appeal Tribunal

586 notes

·

View notes

Text

ROBERT REICH

MAR 14

Friends,

It seems as if the horrendous Trump news doesn’t end — and it doesn’t. We’ve barely endured just over seven weeks of his scourge and every day brings new awfulness.

But the worse it gets, the more Trump, Musk, and the rest of the oligarchy reveal themselves. And the more they reveal themselves — the more they abuse their wealth and power, side with Putin, trample civil liberties, and ride roughshod over the Constitution — the stronger the backlash against them will be.

Here’s this week’s summary of 10 reasons for very modest optimism.

1. The Trump slump is worsening.

The first reason for very modest optimism is the current bad economic news. Americans voted for Trump because they thought he’d fix the economy. Many are now suffering buyer’s remorse.

On Monday, in retaliation for Trump’s tariffs on Chinese imports, China began imposing tariffs on a range of American farm products, including a 15 percent levy on chicken, wheat, and corn. This is already beginning to hurt the Farm Belt — mostly Republican states and Trump voters.

On Wednesday, after Trump’s 25 percent tariffs on all aluminum and steel imported into the U.S. went into effect, the European Union announced retaliatory tariffs on about $28 billion worth of products, including beef and whiskey — also mostly produced by Republican states (think Kentucky bourbon). Europe is also slapping tariffs on Harley-Davidson motorcycles, made in the Rust Belt.

In response this morning, Trump threatened a 200 percent tariff on all alcoholic products from EU member states. As a result, Trump voters — largely working-class — will be paying more.

Canada also announced new tariffs on about $21 billion worth of U.S. products.

What does this all mean for the economy?

In a Fox News interview that aired Sunday, Trump did not rule out the possibility that his policies would cause a recession. That possibility is growing by the day.

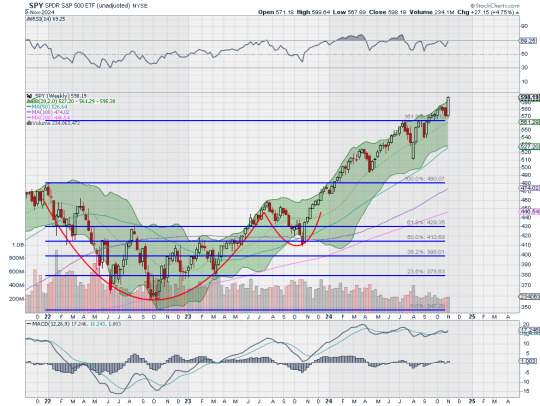

The stock market has continued to plummet. Yesterday, the S&P 500 fell 1.4 percent; the index is now down 10.1 percent from its peak reached less than one month ago and in a “correction” — Wall Street slang for when an index falls 10 percent or more from its peak and when investors worried about a sell-off gathering steam.

Other major indexes, including the Russell 2000 and the tech-heavy Nasdaq Composite, were already in correction territory.

The rest of the economy isn’t far behind.

Last Friday’s jobs report showed employers adding 151,000 jobs in February — half as many as in November and December. Leisure and hospitality jobs have declined in the past two months, suggesting that consumers are pulling back on discretionary spending.

The labor force participation rate also fell 0.2 percentage points, to 62.4 percent, mostly due to declining employment among men. The number of workers employed part-time who wanted but couldn’t get full-time work increased by 460,000 to 4.9 million, the most since spring 2021.

CEOs’ assessment of American business conditions is the lowest since the spring of 2020. The New York Times monthly consumer survey finds households feeling gloomy about their year-ahead financial situations.

The Federal Reserve Bank of New York reported Monday that Americans are increasingly worried about the state of their finances. The perceived probability of missing a minimum debt payment over the next three months climbed to its highest level since April 2020, when the economy was in a Covid-19-related freefall.

Egg prices, an emerging symbol of America’s affordability crisis, jumped 10.4 percent last month after a big rise in January.

2. Trump’s support continues to tank.

The consequence of all this for Trump’s political support? It’s tanking. In the latest Emerson national poll, 46 percent of voters say his policies are making the economy worse rather than better, while 28 percent say the opposite (the rest had no opinion).

In a new CNN/SSRS poll, almost three-quarters of Americans view the current economic conditions in the U.S. as poor, 51 percent of the public say they think Trump’s policies have worsened economic conditions, and just 28 percent say that his policies have improved things.

In the same poll, the share of Americans saying they expect the economy to be in bad shape a year from now is up 7 points since January, just before Trump took office.

Fifty-five percent of Americans surveyed say they fear Trump’s cuts to federal programs will negatively affect the economy, and just over 50 percent say that they will negatively affect their own families or local communities.

In a new YouGov poll, 48 percent of Americans think the economy is getting worse, up from 37 percent at the start of Trump's second term. Forty-seven percent expect higher inflation in six months — more than twice the share six months ago.

In the latest Quinnipiac poll, 54 percent disapprove of Trump’s handling of the economy; only 41 percent approve.

In a new CNN poll, 56 percent of voters disapprove of Trump’s handling of the economy — higher than at any point during his first term. In addition, 61 percent disapprove of tariffs.

I don’t have huge trust in polls but when all major polls show the same thing, there’s reason to believe them.

3. Musk’s claimed savings don’t exist, and his businesses are going down the toilet.

Musk continues to claim big savings from his DOGE effort to take a chainsaw to government. But so far, the actual savings have proven to be tiny.

Soon there will be no way to tell, because Musk and DOGE have just stopped providing identifying details about the cuts — so there’s no way to fact-check them. Not only is this a major step backward from Musk’s promise that he’d be “maximally transparent,” but also it makes his claims of savings nothing but unverifiable propaganda.

DOGE has refused to answer Freedom of Information Act (FOIA) requests from journalists and watchdog groups. On Monday, though, a federal judge ruled that DOGE is likely subject to the FOIA — a win for journalists, watchdogs, and researchers who have demanded greater transparency. On Thursday, another judge ordered Musk and DOGE to turn over records and answer questions in response to a legal complaint filed by Democratic state attorneys general.

Meanwhile, Musk’s growing political power and his shift to the political hard right are damaging his businesses.

Consumers are boycotting Tesla. More than a dozen violent or destructive acts have been directed at Tesla facilities. Tesla’s stock has fallen by more than 35 percent since Trump’s inauguration; it’s down 50 percent since December.

Musk is so alarmed by this that he got Trump to hold a White House promotional event for Tesla this week — where Trump essentially read a Tesla sales pitch and lied that consumer boycotts are “illegal.”

In Germany, sales of Teslas plummeted 76 percent in February compared with a year earlier, according to figures released Wednesday.

Antipathy to Musk is also denting sales of his Starlink satellite internet business.

Musk raised alarms this past weekend when he wrote on X that Ukraine’s front line “would collapse” against Russian forces if Starlink were shut off.

Radoslaw Sikorski, Poland’s foreign minister, suggested that his country “will be forced to look for other suppliers” if Starlink is “unreliable.” Musk later told Sikorski to “be quiet, small man.”

Andrius Kubilius, the European Union commissioner overseeing defense and space, talked of quickly replacing Starlink if necessary.

Italy is having second thoughts about awarding a $1.6 billion contract to Starlink.

Over the past week, shares in Eutelsat — the French rival to Starlink — have more than tripled.

4. The FBI is moving to criminalize groups like Habitat for Humanity for receiving grants from the Environmental Protection Agency under the Biden administration.

I’m including this as a reason for optimism because it so clearly demonstrates just how absurd and extreme the Trump regime has become.

On Wednesday, Citibank revealed in a court filing that it was told to freeze Habitat for Humanity’s bank accounts, at the FBI’s request. The reason? The FBI alleges that the group is involved in “possible criminal violations,” including “conspiracy to defraud the United States.”

Habitat for Humanity, you may recall, is the group that builds low-income houses in America’s communities. Jimmy Carter worked with them for decades. What did they do to earn the FBI’s ire? They received a climate grant from the Biden administration’s EPA.

Other nonprofits also being targeted by the FBI for receiving climate grants include the Appalachian Community Capital Corporation, the Coalition for Green Capital, and the DC Green Bank.

Yet these groups’ applications for government grants for environmental work were fully reviewed and accepted by the Biden administration’s EPA.

This is not fraud. It’s targeted harassment. And it will be viewed that way by most Americans.

5. Trump’s “beautiful bill” is stranded.

Trump apparently believes that fees from his tariffs when added to savings from Musk’s budget cuts will enable him to finance another large tax cut mainly for big corporations and the wealthy.

Even if he’s correct (which seems extremely doubtful), those tariff fees are financed by American consumers who will be paying higher prices for imports and who’ll also be losing services because of Musk’s cuts. They are are largely working-class Trump voters. Talk about reverse Robin Hood.

Meanwhile, Republicans in control of the House and Senate are divided over the size of spending reductions that should accompany their pending tax cuts, which budgetary yardstick they use, and whether a debt-ceiling increase should be attached.

The Senate still hasn’t agreed to the House strategy to pass one bill that would address the fiscal matters along with border security, after months of debate over whether to split Trump’s priorities into two or even three party-line bills.

Until these questions are resolved with an agreement between House and Senate Republicans, Congress can’t unlock the door to the fast-track “reconciliation” process that circumvents Senate Democrats. And until they unlock that door — which could take weeks or months — Trump’s “one big, beautiful bill” is stranded.

6. Bernie is rallying the Democrats

On Friday night, Bernie Sanders drew a crowd of 4,000 in Kenosha, Wisconsin, in what he calls his “Stop Oligarchy Tour.” On Saturday morning, another 2,600 in Altoona, Wisconsin, a town of less than 10,000 residents. Then 9,000 in suburban Detroit, where United Auto Workers President Shawn Fain introduced him.

Each stop has been in a swing House district represented by a Republican.

Rep. Alexandria Ocasio-Cortez will join Bernie on the road in the coming weeks. She’s also planning solo appearances in Republican-held congressional districts in Pennsylvania and New York and other districts where Republicans have declined to hold in-person town halls because they might face protests.

Elizabeth Warren and Greg Casar headlined a 3,500-person rally in Austin,Texas — the heart of Musk’s business empire.

Tim Walz and many House Democrats will host town halls in GOP districts where their Republican congressmen are avoiding town halls.

Bernie is showing Democratic lawmakers and prospective candidates how hungry Americans are for a strong counteroffensive against Trump and Musk — in contrast to Democratic political operative James Carville’s suggestion that Democrats “roll over and play dead,” and Minority Leader Chuck Schumer’s willingness to surrender to Republicans on the budget resolution.

7. A coalition of 21 Democratic attorneys general has sued Trump, and the federal courts are becoming even more active in stopping him.

On Thursday — two days after the Education Department fired more than 1,300 workers, purging people who administer grants and track student achievement across America — a coalition of Democratic attorneys general sued the Trump regime, saying that the dismissals were “illegal and unconstitutional.”

The coalition is seeking a court order to stop what it calls “policies to dismantle” the department.

Meanwhile, Judge Beryl Howell of the U.S. District Court for the District of Columbia condemned Trump’s executive order punishing law firms that have had Democratic clients, such as special counsel Jack Smith — denying their attorneys access to federal buildings and stripping them of government contracts.

On Thursday, U.S. District Judge William Alsup ordered federal agencies to rehire tens of thousands of probationary employees who have been fired by Trump. Judge Alsup described the mass firings as a “sham” strategy by Trump’s Office of Personnel Management to sidestep legal requirements for reducing the federal workforce.

Alsup ordered that probationary employees across DOD, Treasury, Energy, Interior, Agriculture, and the VA be hired back “immediately.” Alsup also lashed out at the Justice Department over its handling of the case, saying Trump lawyers were hiding the facts about who directed the mass firings.

Another federal judge has blocked the deportation of Columbia University graduate student Mahmoud Khalil, whose green card was voided by the Trump regime and was then imprisoned for his political views.

8. Oligarchs are revealing themselves for who they really are.

This week further revealed how the American oligarchy is using their wealth to curry favor with Trump. Some examples:

Jeff Bezos has decided to stream all seven seasons of Trump’s former reality show, “The Apprentice,” on Amazon Prime. Trump was an executive producer and is likely to receive royalties from the agreement. He even plugged the deal on Truth Social.

Bezos’s Amazon is also paying $40 million for a documentary about the life of Melania Trump. According to The Wall Street Journal, she’s set to make $28 million from the deal.

Bezos has also washed his Washington Post clean of any op-eds critical of Trump (leading to the resignation of some of its top opinion writers, such as Ruth Marcus) and refuses to carry ads critical of Trump.

Meanwhile, Musk, the wealthiest person in the world, who spent more than $250 million to help elect Trump, is donating an additional $100 million to help further Trump’s agenda.

9. Other nations are uniting against Trump, and the global right is losing ground.

It’s also become apparent this week that Trump is, ironically, the great unifier of Europe. Trump’s policies have helped leaders who were struggling with stagnant economies and rightwing opponents. Facing down American tariffs and drawing together to confront an ally that is behaving more like an adversary has proved to be good politics.

British Prime Minister Keir Starmer’s whirlwind of diplomacy — trying to marshal a European peacekeeping force for Ukraine while also working to salvage the alliance with Washington — has won him praise across Britain’s political spectrum. Starmer’s poll numbers have bounced back from what was a dismal first six months in government.

In Mexico, President Claudia Sheinbaum has won praise and stratospheric poll numbers for her coolheaded handling of Trump’s tariffs. Mark Carney, a former central banker, was catapulted to the leadership of Canada’s Liberal Party with 86 percent of the vote on the belief that he can manage a trade war with the United States.

Carney’s party, which lagged the Conservatives by double digits under the premiership of Justin Trudeau, has recently closed the gap, putting the Liberals within striking distance of a victory in an election that Carney is expected to call soon. The Conservative leader, Pierre Poilievre, has struggled to regain momentum, and Liberals have been quick to paint him as a Canadian Trump.

10. Americans will soon feel the effects of the Trump-Musk chainsaw.

Most Americans don’t care terribly much that government workers are being axed, but they do care about government services being axed. They’re about to feel those effects very soon. This is also cause for modest optimism because the sooner most people feel those effects, the stronger will be the backlash against the Trump regime. Consider, for example:

— Weather. The National Weather Service produces lifesaving forecasts, but Trump is cutting 20 percent of the National Oceanic and Atmospheric Administration — hobbling weather forecasts.

— Food stamps. Millions of poor families, many in red states, rely on Supplemental Nutrition Assistance — food stamps — to have enough to eat. The Trump regime is making substantial cuts and wants states to make up the difference. Most red states cannot.

— Veterans benefits. Over 9 million veterans depend on benefits from the Veterans Administration. But Trump’s cuts at the VA have disrupted medical treatment, ended studies involving experimental treatments, forced some facilities to fire support staff, and created uncertainty amid the mass cancellation of hundreds of VA contracts. The VA serves a constituency courted heavily by Republicans. Veterans, including Republican-leaning vet groups, are fighting back against Trump’s VA cuts.

— Measles. With lower rates of vaccination against measles and a vaccine skeptic at the helm at HHS, we’re witnessing significant measles outbreaks in Texas and New Mexico that have infected more than 250 people — many of them unvaccinated school-age children — and claimed two lives; a flu season that led to record numbers of hospitalizations; and the potential for a bird flu epidemic.

— Tuberculosis. Americans are vulnerable to communicable diseases that exist in other nations, such as tuberculosis, which kills more people worldwide than any other infectious disease. But since Trump ordered the freeze on USAID, the entire system of finding and treating TB has collapsed in dozens of countries across Africa and Asia.

— Education. On Tuesday, Trump and Musk fired half the Education Department, purging people who administer grants and track student achievement across America. Education cuts will hurt red states in particular: States that voted for Trump last November, on average, use more federal funding in their education apportions than states that voted for former Vice President Harris.

— Social Security. More than 100 million Americans depend on Social Security. But Musk’s DOGE is now combing through Social Security databases to flag suspicious payments. Musk describes Social Security as rife with fraud and repeats the conspiracy theory that Democrats have used it as a “gigantic magnet to attract illegal immigrants and have them stay in the country.” Earlier this month, he referred to Social Security as “the biggest Ponzi scheme of all time.”

This week, DOGE tried to eliminate Social Security’s phone customer service, only to scrap the plan after massive public backlash (although DOGE is still cutting phone options for direct deposit changes).

***

I offer you these reasons for very modest hope not because I want you to deny the awfulness of what’s occurring, but because I want you to see we are not necessarily doomed. Not all is lost. There are reasons to believe that the vast majority of Americans are catching on. And if that’s the case, the scourge will be over. We may even be stronger for having gone through it.

93 notes

·

View notes

Text

economic advice and timely buying tips: 2025 transits

as of late, social media has many discussions about what to buy - or avoid buying - over the next few years, largely in response to the political climate in the united states. across europe, many regions are actively preparing their populations for potential crises (sweden's seems to be the most popularly discussed - link). due to the urgency and pressure to act, as if the world might change tomorrow (and it could though i believe we still have time in many places), i’ve decided to analyze the astrological transits for 2025. in this post i provide practical economic advice and guidance on how much time astrology suggests you have to make these purchases everyone is urging you to prioritize. if it seems to intrigue people i’ll explore future years as well.

things the world needs to prepare for in 2025 in my opinion and why my advice is what it is: the rise of ai / automation of jobs, job loss, geopolitical tensions, war, extreme weather, inflation, tariffs - a potential trade war, a movement of using digital currency, the outbreak of another illness, etc.

paid reading options: astrology menu & cartomancy menu

enjoy my work? help me continue creating by tipping on ko-fi or paypal. your support keeps the magic alive!

uranus goes direct in taurus (jan 30, 2025)

advice

diversify investments: avoid putting all your money in one asset type. mix stocks, bonds, index funds, and, if you feel comfortable, look into sustainable investments or new technologies.

digital finance: familiarize yourself with digital currencies/platforms or blockchain technology.

build an emergency fund: extra savings can shield you from sudden economic instability. aim for 3-6 months’ worth of expenses.

reevaluate subscriptions and spending: find creative ways to reduce spending or repurpose what you have. cancel subscriptions that don't align with needs/beliefs, cook at home, or diy where possible.

invest in skills / side hustles: take a course/invest in tools that can help you create multiple income streams.

by this date stock up on

non-perishable food items like canned goods, grains, and dried beans. household essentials like soap, toothpaste, and cleaning supplies. basic medical supplies. multi-tools. durable, high-quality items over disposable ones (the economy is changing, buy something that will last because prices will go up). LED bulbs, solar-powered chargers, or energy-efficient appliances. stock up on sustainable products, like reusable bags and water bottles. blankets. teas. quality skincare.

jupiter goes direct in gemini (feb 4, 2025)

advice

invest in knowledge: take courses, buy books (potential bans?), and/or attend workshops to expand your skill set. focus on topics like communication, writing, marketing, and/or technology. online certifications could boost your career prospects during this time.

leverage your network: attending professional events, joining forums, and/or expanding your LinkedIn presence.

diversify income streams: explore side hustles, freelance gigs, and/or monetize hobbies.

beware of overspending on small pleasures: overspending on gadgets, books, or entertainment will not be good at this point in time (tariffs already heavy hitting?).

by this date stock up on

books / journals. subscriptions to learning platforms like Skillshare, MasterClass, or Coursera. good-quality laptop, smartphone, and/or noise-canceling headphones. travel bags - get your bug out bag in order. portable chargers. language-learning apps. professional attire. teas. aromatherapy.

neptune enters aries (march 30, 2025)

advice

invest: look into industries poised for breakthrough developments, such as renewable energy, space exploration, and/or tech.

save for risks: build a financial cushion to balance your adventurous pursuits with practical security.

diversify your income: consider side hustles or freelancing in fields aligned with your passions and talents.

"scam likely": avoid “get-rich-quick” schemes or ventures that seem too good to be true.

adopt sustainable habits: focus on sustainability in your spending, like buying high-quality, long-lasting items instead of cheap, disposable ones.

by this date stock up on

emergency kits with essentials like water, food, and first-aid supplies. multi-tools, solar chargers, or portable power banks. art supplies. tarot or astrology books (bans?). workout gear, resistance bands, or weights. nutritional supplements. high-quality clothing or shoes.

saturn conjunct nn in pisces (april 14, 2025)

advice

save for the long term: create a savings plan or revisit your budget to ensure stability.

avoid escapism spending: avoid unnecessary debt.

watch for financial scams: be cautious with contracts, investments, or loans. research thoroughly and avoid “too good to be true” offers.

focus on debt management: saturn demands accountability. work toward paying down debts to free yourself from unnecessary burdens.

build a career plan: seek roles / opportunities that balance financial security with fulfillment, such as careers in wellness, education, creative arts, or nonprofits.

by this date stock up on

invest in durable, sustainable items for your home or wardrobe that offer long-term value. vitamins or supplements. herbal teas or whole grains. blankets. candles. non-perishable food. first-aid kits. water. energy-efficient devices.

pluto rx in aquarius (may 4, 2025 - oct 13, 2025)

advice

preform an audit: reflect on how your money habits and your long-term goals.

make sustainable investments: support industries tied to innovation, like renewable energy, ethical tech, or sustainable goods.

expect changes: could disrupt collective systems, so build an emergency fund. plan for potential shifts in tech-based industries or automation. AI is going to take over the workforce...

reevaluate subscriptions and digital spending: cut unnecessary costs and ensure your money supports productivity. netflix is not necessary, your groceries are.

diversify income streams: brainstorm side hustles or entrepreneurial ideas.

by this date stock up on

external hard drives. cybersecurity software. portable chargers. solar panels. energy-efficient gadgets. non-perishable food. clean water supplies. basic first-aid kits and medications. portable generators. books on technology and coding. reusable items like water bottles, bags, and food storage. gardening supplies to grow your own food. VPN subscriptions or identity theft protection.

saturn enters aries (may 24, 2025)

advice

prioritize self-reliance: build financial independence. create a budget, eliminate debt, and establish a safety net to support personal ambitions. avoid over-reliance on others for financial stability/decision-making.

entrepreneurship: consider starting a side hustle / investing in yourself.

save for big goals: plan for major life changes, such as buying property, starting a business, etc. make a high yield saving account for these long-term goals.

by this date stock up on

ergonomic office equipment. home gym equipment. non-perishable foods and water supplies for potential unexpected disruptions. self-protection; consider basic tools or training for safety. high-protein snacks, energy bars, or hydration supplies. supplements like magnesium, B-complex vitamins, etc. stock up on materials for DIY projects, hobbies, or entrepreneurial ventures.

jupiter enters cancer (june 9, 2025)

advice

invest in your home: renovating what needs renovating. saving for a down payment on a house.

focus on security: start or increase your emergency savings. consider life insurance or estate planning to ensure long-term security for your family/loved ones.

embrace conservative financial growth: cancer prefers security over risk. opt for conservative investments, like bonds, real estate, and/or mutual funds with steady returns.

focus on food and comfort: spend wisely on food, cooking tools, or skills that promote a healthier, more fulfilling lifestyle (maybe this an RFK thing for my fellow american readers or this could be about the fast food industry suffering from inflation).

by this date stock up on

furniture upgrades if you need them. high-quality cookware or tools. stockpile your pantry staples. first-aid kits, fire extinguishers, and home security systems. water and canned goods for emergencies. paint, tools, or materials for DIY projects. energy-efficient appliances or upgrades to reduce utility costs.

neptune rx in aries/pisces (july 4, 2025 - dec 10, 2025)

advice

avoid financial conflicts: be mindful of shared finances or joint ventures during this time.

avoid escapist spending: stick to a budget.

by this date stock up on

first-aid kits, tools, and essentials for unforeseen events. water filter / waterproof containers. non-perishables and emergency water supplies.

uranus rx in gemini/taurus (july 7, 2025 - feb 3, 2026)

advice

evaluate technology investments: make sure you’re spending money wisely on tech tools, gadgets, or subscriptions. avoid impulsively purchasing the latest gadgets; instead, upgrade only what’s necessary.

diversify streams of income: explore side hustles or gig work to expand your income sources. focus on digital platforms or innovative fields for additional opportunities.

reassess contracts and agreements: take time to revisit financial contracts or business partnerships. ensure all terms are clear and aligned with your goals.

prioritize financial stability: uranus often brings surprises, so focus on strengthening your savings and emergency fund.

avoid major financial risks: uranus retrograde can disrupt markets. avoid speculative ventures and focus on stable, low-risk options.

by this date stock up on

lightweight travel gear or items for local trips. radios, power banks, or portable hotspots in case of disruptions in digital connectivity. stockpile food, water, and household goods to maintain stability during potential disruptions. invest in high-quality, long-lasting items like tools, clothing, or cookware.

saturn rx in aries/pisces (july 13, 2025 - nov 27, 2025)

advice

review career: assess whether your current job or entrepreneurial efforts align with your long-term aspirations (especially considering the state of the world). adjust plans if needed.

strengthen emergency funds: aries energy thrives on readiness. use this time to build/bolster a financial safety net for unforeseen events.

prepare for uncertainty: build a cushion for unexpected financial changes, especially if you work in creative, spiritual, or service-oriented fields.

by this date stock up on

health products that support long-term well-being. essential supplies like first-aid kits, multi-tools, or non-perishables. bath products. teas. art supplies. drinking water or water filtration tools.

jupiter rx in cancer (nov 11, 2025 - march 10, 2026)

advice

strengthen financial foundations: building an emergency fund or reassessing your savings strategy. ensure everything is well-organized and sustainable.

by this date stock up on

quality kitchenware, tools, or cleaning supplies. pantry staples and emergency food supplies.

have ideas for new content? please use my “suggest a post topic” button!

return to nox's guide to metaphysics

return to the masterlist of transits

© a-d-nox 2024 all rights reserved

#astrology#astro community#astro placements#astro chart#astrology tumblr#astro notes#astrology chart#astrology readings#astro#astrology signs#astro observations#astroblr#astrology blog#astrology stuff#natal astrology#transit astrology#transit chart#astrology transits

98 notes

·

View notes

Text

「 Oathbreaker 」

summary: Her brazen defiance of his allegations and her insistence on proving her piety has angered Astarion in a way he can't quite put into words, but he knows that the way she rejects what he knows so intimately to be true in service of her own self-preservation is maddening and incompatible with reality.

“You vex me.”

━ ◆ ━

Or, Paladin Tav's insistence on helping everyone the party comes across irritates Astarion to no end. He decides to test the limits of her virtue.

pairing: Astarion/f!Reader rating: 18+ MDNI status: complete tags/warnings: oral (female receiving), vaginal sex, vaginal fingering, blood drinking, shameless smut, hate sex/angry sex, rough sex, dirty talk, biting, brief mentions of past trauma/abuse, reader insert word count: 4.7k spoiler warning: minor spoilers for astarion's past through act 1.

a/n: cross-posted as always from AO3.

━━━━━━━━━━━━━ ◆ ━━━━━━━━━━━━━

It’s nearing dusk when the party decides to stop and make camp for the evening on the edge of the forest that they’ve just spent the last several days trudging through tirelessly. As they emerge wearily from the trees, Tav is the first to spot the small stone building at the crest of a small hill and can barely contain her excitement as she recognizes the colors adorning its walls.

“I can’t believe there’s a temple of Tyr all the way out here,” she says, finding a sudden surge of newfound strength as she bounds towards the foot of the hill. Her exhausted party follows after an exchange of disgruntled looks, lest there be some sort of ambush waiting for them inside.

As endearing as she often is, Tav is nothing if not recklessly optimistic.

The temple is thankfully deserted, and they all take a quick look inside before most of them excuse themselves to make camp. Tav, however, lingers after the others have left. As a paladin who has dedicated herself to Tyr, she is thankful to have found a place to stop and offer her prayers – and hopefully receive some blessings for the long journey ahead of them.

As the heavy oak doors swing shut, Tav suspects that she is alone, but a small noise alerts her and she turns to see Astarion not too far away, watching her carefully.

She’s surprised he’s still here.

“I didn't take you for a religious man, Astarion,” Tav says. She approaches the altar in the center of the temple, draped with the familiar blue and gold colors that represent Tyr and his followers. Overhead, twin banners frame a marble statue of Tyr himself, the fabric emblazoned with the golden hammer and scales that signify his creed of law and justice.

She bows her head in reverence, her hands clasped together in front of her.

“I'm not,” Astarion says blandly, making his way lazily throughout the open hall. “Call it mere... curiosity. But go on, don't let me distract you.”

He waves his hand dismissively, but Tav pauses what she's doing anyway and beckons him towards her.

“Would you... like me to show you how to pray?” she asks him. “You could do with a little positive influence.” The smile she offers him is kind.

“Tempting,” Astarion says, placing his index finger on his chin and pretending to consider the offer. “But I'll pass. You've already got the market cornered, I'm afraid.”

It's clear he has no intentions pf humoring her, and she heaves a heavy sigh.

“It wouldn't hurt you, you know - to be a little kinder,” she admonishes. “You can't solve all your problems with a dagger.”

His eyes gleam playfully as a graceful smirk slides effortlessly across his face. “That's what the short bow is for, darling.”

It's all Tav can do not to glare at him. She settles instead for a less enthusiastic scowl, her face full of disappointment.

“Must you always be so frustrating?”

“I prefer the term ‘pragmatic,’” Astarion quips back, not missing a beat. “It's all part of my charm.”

“Look,” Tav says evenly, closing her eyes and pinching the bridge of her nose in frustration. “All I'm saying is that maybe if you acted a little more heroic every once in a while, you'd realize that people are far more receptive to kindness than violence.”

Astarion huffs and rolls his eyes. “Those who claim to be heroes are either fools or martyrs,” he says simply. There is no inclination that he's being insincere with his words.

“This world is full of nothing but cruelty, and those who take advantage of that fact will always use that power to bring the weak to heel.”

It's a simple fact of life that has been ingrained into Astarion in the most painful way for the last two hundred years of his life. It is, perhaps, the greatest truth that he knows.

Tav's naive valor has always been one of her most exhausting traits, Astarion thinks grimly.

Tav, meanwhile, expresses her indignation as she turns sharply on her heel to face him, brows knit and her lips drawn tight.

“You're wrong, Astarion,” she says sternly. “There are plenty of good people out there, people like me, who –”

Astarion interrupts her retort with a mocking scoff and stalks closer to her, the soft sound of his boots across the stonework the only sound he makes. He levels a glance at her, and when she meets his eyes she find them full of menace.

“People like you?” he parrots back. “You don't seriously expect me to believe that you risk your life for every wretched soul who stumbles across your path purely out of the goodness of your heart.”

Tav has never seen him this upset before. She can practically feel the anger radiating off of him now, his whole body tense, his hands balled into fists at his sides.

She isn't sure what to make of it and doesn't have the time to consider why this, of all things, seems so personal to him before Astarion suddenly relaxes his posture, as if he's trying to regain his composure.

Astarion narrows his eyes and regards her silently, and she feels as though he's staring right through her. The tadpole in her head squirms suddenly, and she has the inkling that he's considering trying to pry his way into her innermost thoughts to drag the truth from her if she will not freely give it to him.

Then as quickly as it came, the sensation fades, and Tav's mind steadies, though the exchange has set her on edge.

“You have something to gain, just like everyone else,” Astarion concludes. “The only difference,” he says with a wry smile, “is that you're hiding behind righteous selflessness. I, on the other hand, have no such compunction.”

Tav considers his words carefully, the accusation that she is only helping other people because it somehow benefits her own sense of self-worth cutting her to the bone.

She's angry because she knows there is some truth to what he's saying, but she won't give him the satisfaction.

“No,” she bites out, “I help people because it's the right thing to do. I swore an oath to defend those who can't defend themselves. That alone is reward enough.”

Astarion seems to sense her deception and seizes on it. The smirk on his face is nothing if not wicked as he leans in close, his brows arched.

“Really?” he says. “Then I have to wonder, how long did it take for you to become so blindly obedient that you no longer allow yourself to act on your own self interests?”

His voice lowers an octave, and when he speaks again it sends a cold shiver down her spine.

“No matter how much you'd like to do otherwise?”

He could almost laugh at the irony of his words if the reality wasn’t so tragic. The obedience he sees in her, a sick, twisted reflection of his relationship with Cazador, is enough to make him seethe with rage. The only difference is that Tav had a choice - she chose to surrender her autonomy when he never had that luxury.

Tav rounds on him now, her face hot with anger.

“That's not true! Just because I choose to follow Tyr's teachings doesn't mean that I don't have free will. I'm not a slave.”

Astarion bristles as the word leaves her mouth.

She doesn't know, she couldn't know, but it doesn't make her words any less destructive.

He's towing over her now, his expression dark. When she tips her chin up to look at him, Tav flinches at the scorned look on his face. In the back of her mind, a voice tells her to run, but she reasons with herself that Astarion, as prickly as he can be, would never hurt her.

Instead, she steels herself and gathers the courage to stare him down.

“You're wrong,” she repeats again.

“Then prove me wrong,” he snarls. “Do one thing, just one, that you want to do just for the sake of doing it. Not because you think it will win the favor of some pathetic god who probably doesn't even care that you exist.”

Tav ignores the casual dismissal of her beliefs and does something that surprises even Astarion. Fisting her hand in his doublet, she grabs Astarion firmly and tugs him forward, crashing their lips together in an awkward, clumsy kiss.

His lips are cold to the touch, a detail that she had not anticipated, and she considers pulling away. After all, her point has been made, has it not?

The kiss feels liberating, in a way. Astarion had been shamelessly flirting with her since the first night they made camp, and despite her repeatedly rebuffing his advances, it was never because she hadn't found him suitable to her tastes.

But Astarion's hand is immediately behind her back, holding her firmly against him and preventing her from escaping. He presses his mouth against her as tongue glides across her lower lip, a growl rumbling low in his throat.

When Tav parts her lips to suck in a breath, Astarion plunges his tongue into her mouth, tasting her with a hungry fervor. The hand on her back crushes her against his body, and she kisses him back, gasping breathlessly as she feels the sudden prick of his fangs.

Astarion's grip on Tav's thighs is possessive as he hoists her up onto the altar, scattering the unlit candles and other trinkets in his way. The sharp edge of the stone bites into her skin, granting her a moment of clarity. She realizes his intentions as Astarion fumbles impatiently with the leather straps of her armor, tugging at the buckles on her waist.

“Astarion,” she says, placing a tentative hand on his shoulder, “we shouldn't – it's not proper – not here.” She casts her eyes up to the statue of Tyr that looms over them, its cold marble eyes watching them in silent judgement.

“And why not, love?” Astarion says smoothly, freeing the last buckles of Tav's cuirass and casting it hastily aside. It hits the floor with a muffled thud, and his fingers quickly turn to the buttons of her undershirt.

“I can think of no better place for you to give yourself up as an offering.”

When Astarion cranes his neck to look at Tav through half-lidded eyes, he flashes her a sly smile, his fangs bared.

“I will enjoy corrupting you,” he croons softly. “I do so hope Tyr will be watching as you come apart for me.”

The way he says it sends a tendril of searing heat directly to her core, and she feels herself growing desperate and needy. The slick arousal between her legs betrays any remaining reluctance she had left, and she gives up trying to talk him out of taking her in such a sacred place.

Astarion tugs fervently at the buttons on Tav's shirt, but he's not making progress fast enough. In a bout of frustration, he balls his fists up in the fabric and callously wrenches it open, scattering the remaining buttons as the shirt tears beneath his hands.

Tav makes a short noise of protest for her ruined shirt, but Astarion silences her with another punishing kiss and pushes himself between her open thighs.

After shrugging out of his doublet, Astarion makes quick work of Tav's shirt and her underclothes, which swiftly join the unceremonious pile with Tav's discarded leathers.

Her brazen defiance of his allegations and her insistence on proving her piety has angered Astarion in a way he can't quite put into words, but he knows that the way she rejects what he knows so intimately to be true in service of her own self-preservation is maddening and incompatible with reality.

Too many times Cazador had taken advantage of Astarion. Too many times he had tortured and used him for his own personal gain, and not once did anyone reach out to intervene.

Not once did anyone save him from his suffering. Not until the mind flayers snatched him right out from under Cazador's clutches and implanted the godsdamned parasite in his brain.

“You vex me,” mutters bitterly, brows furrowed.

Tav regards him curiously, her expression questioning, but she says nothing.

When Astarion presses his face into the crook of her neck and his lips find her pulse point, Tav hitches a breath and her body moves of its own accord, her back arching into him as though it craves the contact. The cold from his pallid skin seeps into her body, and when his hand trails up her torso before finally cupping her bare breast, she lets out the moan she's been holding back since he first returned her kiss.

Astarion grins triumphantly against Tav's neck and presses his fangs into the soft, smooth skin above her carotid artery.

She's no better than the rest of them. Defiant as she is, she's succumbed to him like so many others before her.

There is no true good in this world, he reminds himself. Only those who take advantage and those who allow themselves to become their prey.

The hand on Tav's breast squeezes roughly as his fingers find her nipple; when he pinches the tender bud, Tav cries out beneath him, writhing in pleasure. She grasps at him feebly, one hand tangling in his hair as the other finds purchase in his tunic.

“Tell me,” he muses, “why did you let me have your blood that night?”

“I - what?”

Tav wills herself to focus on his question, eventually realizing that he's talking about the night he had tried to bite her when everyone else was sleeping. He had asked so sweetly to let him drink her blood, she remembers. Of course, she hadn't been able to say no to him.

“Was it pity?” Astarion sneers. “Did you see me as yet another one of your little charity cases?” His tone is scathing and dripping with venom.

Tav sees no point in lying to him any longer, not when he already knows the truth.

“You said you needed it,” she responds flatly. “I was only trying to help.”

“How predictable,” he scoffs. “I don't need your pity.”

With his free hand, Astarion grips Tav firmly by the chin and forces her head to the side, baring the full column of her throat to him. She anticipates his bite before it happens, and when his teeth sink into her neck it feels like ice being injected into her veins.

Tav moans pitifully as Astarion's tongue laps over her skin to encourage the flow of her blood, and she can hear him swallow greedily as it surges into his mouth.

A thin rivulet of blood trickles from the corner of his mouth and Tav feels a few crimson droplets pepper her chest, causing her to shudder as they grow cold on her skin.

Desperate for something more substantial to cling to, Tav throws her arms around Astarion's body, digging her nails into his back and dragging them across his shirt, hard enough to leave marks even through his tunic.

Astarion groans at the sensation but does not stop her.

He drinks greedily from her veins, gorging himself on her blood, feeling the warmth flooding through his body. The taste is just as he remembered, so sweet and agonizingly addictive.

It requires a great effort for Astarion to pry his mouth away from Tav’s neck. When he finally wills himself to pull back, she looks up at him through dark, unsteady eyes, her lips parted to allow her shallow, panting breaths.

He draws his thumb over his mouth and gathers any remaining traces of blood before running his tongue across it, savoring every last drop.

“Exquisite,” he breathes. “But now… I have to wonder if the rest of your sinful little body is as delectable as your blood.”

Tav moves without hesitation, unlacing her boots and kicking them off. Astarion’s hands are already at her waist, tugging at her pants and underwear. She lifts her hips just enough for him to yank them down around her ankles, where they fall forgotten to the floor.

When Astarion kneels before the altar, she lets him spread her legs even farther apart, wide enough to bare her body to him. She’s already trembling with anticipation, and she can tell by the pleased noise he makes that he’s noticed how wet she is before he’s even touched her.

“Look at you, sweet thing,” Astarion purrs. “Look how eager you are to have me. You want it, don't you? My mouth on you, tasting you, savoring every last bit of your needy little cunt?”

He drawls out the last few words in a low, possessive tone, and Tav struggles not to whimper.

“Oh gods...” she croaks. “Yes, Astarion. Yes.”

When Tav feels his mouth on the inside of her thigh, she bucks her hips, frustrated by the way he’s purposefully stalling before giving her what she wants.

“Please,” she whines, reaching to grab his hair and push him where she needs him most. Astarion avoids her grasping hands and snatches her wrists in his hand, holding her firmly.

“Ah, ah, ah,” he tuts. “Patience.”

Astarion slowly drags his lips across her thigh as he continues to tease her, occasionally nipping her sensitive skin as he continues his torturous path. When she’s all but certain she’s going to explode, he finally gives in, releasing her wrists as his tongue slides through her slick folds and flicks against her aching clit.

“Fuck, Astarion –!”

Tav keens against him as her body ignites under his mouth, her nerves alight with arousal as he sets to work at pleasuring her, his lips and his tongue bringing her almost immediately to the edge of orgasm. He clearly knows what he’s doing, and she whimpers incoherently, gathering her hands in the blue and gold drapery still strewn across the altar.

Astarion slowly drags his tongue across the slick heat of her core, grazing her entrance. When she feels his tongue probe inside of her, her back arches sharply, and he splays his hands across her waist to keep her from moving.

“Stay still,” he hisses, digging his fingers into her hips.

When Tav appears to comply with his demands, Astarion returns his attention to her clit, using the flat of his tongue to press into her and swirls the tip in practiced, lazy circles. Before long, he presses two fingers inside of her, stretching her open with slow, languid thrusts.

Damn him for being so good at this, Tav thinks sourly, tipping her head back and indulging in the feel of him against and inside her. She knows she’s already lost whatever moral advantage she had over him, and she realizes with only a little shame that she can’t even be bothered to care anymore.

Maybe he was right. Maybe restricting herself this entire time had been nothing but folly. She doesn’t want to interrogate what that means for… well, everything moving forward.

So instead, she focuses on Astarion as he sends wave after wave of pleasure cresting over her, pulling her closer and closer to the edge. She can feel her orgasm building, and as he curls his fingers inside of her, Tav feels her legs begin to shake and prepares herself to give into him completely and let herself go.

The whimper she makes when he suddenly pulls away from her and leaves her gasping and desperate is nothing short of obscene. Astarion rises to his feet, and she searches his face for an explanation, her pupils blown wide as she tries to focus on his face.

“Why –?”

“Not yet,” Astarion answers her bluntly. “I'm not yet through with you.”

He flips Tav unceremoniously onto her stomach and grabs her around the waist, yanking her back so that her legs hang over the side of the altar far enough for her feet to find purchase on the floor. She can hear him behind her as he slips his tunic over his head and unlaces his trousers, the soft leather gliding quietly over his body as he sheds the last of his clothes.

His cock springs free and Tav feels its heavy weight against the swell of her ass as he slides behind her, trailing a single icy finger down the curve of her spine.

“Fuck you,” she grits out through clenched teeth, shifting to make herself more comfortable.

“Ahh,” Astarion says, an amused lilt to his voice as he laughs quietly. “So the little pup has a bite after all. That's good.”

He lifts one of her legs onto the altar to give him better access to her body and spreads her slick folds apart with his fingertips. Tav feels him guide the blunt head of his cock to her entrance, and she groans in frustration, pushing her hips back into him impatiently.

“Astarion... gods, just fuck me already.”

“So impatient,” he scolds her, his fingers digging into her thigh. “But very well. As you wish.”

He slams into her in a single thrust, and Tav moans loudly at the sudden intrusion, his cock stretching her wide as what was initially a sharp pain melts away into pure pleasure. He’s already so deep inside her, and she can feel his cock twitch as he adjusts to her tight, wet heat.

Astarion wastes no time setting a punishing pace, fucking into her hard and fast, coaxing a string of filthy noises from her with every thrust of his hips.

He pins her effortlessly to the altar, one hand secured around her waist and the other pressed between her shoulder blades. The obscene, wet slap of their bodies coming together echoes loudly in Tav’s ears, and she buries her face into the altar in a vain attempt to muffle her cries.

“You're taking my cock so well, pet,” Astarion groans. “What must Tyr think of you now, laid out as you are and moaning like a common whore?”

Tav shoots a scathing glance at him over her shoulder, her teeth bared in a snarl.

“Gods, do you ever stop talking?” she mutters. “You're the last person who should be lecturing me about morality.”

“Hmm, have I struck a nerve?” Astarion asks. “My sincerest apologies.”

His tone is nothing but derisive, and Tav feels her anger rising yet again.

“Asshole.”

Astarion responds by smacking her ass roughly with the flat of his palm, leaving a bright red mark on her skin. The sting and the heat that accompanies it makes her bite her lip, even as she yelps in pain. But she holds her tongue, nevertheless, lest he repeat the punishment.

“And such a mouthy little thing you are. If I had known how feisty you were,” Astarion says, “I would have done this so much sooner.”

His hips continue their relentless pace, snapping into her with enough force to push her across the altar, and several times Astarion grabs her by the hips and pull her back again so that he has enough leverage to fuck her as deeply as he wants to.

Her body feels so incomprehensibly good, and as Astarion continues to pound into her, he feels the tension in his body start to dissipate. If only Tav could see the state she’s in now, so thoroughly disheveled and at his mercy. It gives him endless satisfaction to know that even she can be ruined in such a manner despite all her noble claims of virtue.

Presently Astarion tangles his fingers in Tav’s hair and tugs her body upright, so her back is flush against his chest. She braces herself against the altar with splayed palms, struggling to hold herself up as her aching limbs threaten to give out beneath her.

Astarion can sense her failing strength and wraps an arm around her body as he adjusts himself inside of her, thrusting up into her as he holds her firmly, his hand pressed against the base of her throat. With his spare hand, he brushes the hair away from her shoulder and slots his mouth over her skin once more, sinking his teeth into her tender skin.

Tav cries out weakly as Astarion finds himself indulging in her blood for the second time that evening, pacing himself so that he doesn’t take too much from her. He’s already had more than his fill, and yet he still wants more – he needs more. The sweat on her skin mingles with the heady taste of her blood, and he feels positively intoxicated on her, unable to deny himself the pleasures of her body.

Despite her outbursts, Astarion feels that he should reward her for being so good for him, and he slowly slides his free hand down the length of her stomach, his fingers finding her clit as he teases her back towards sweet, blissful oblivion.